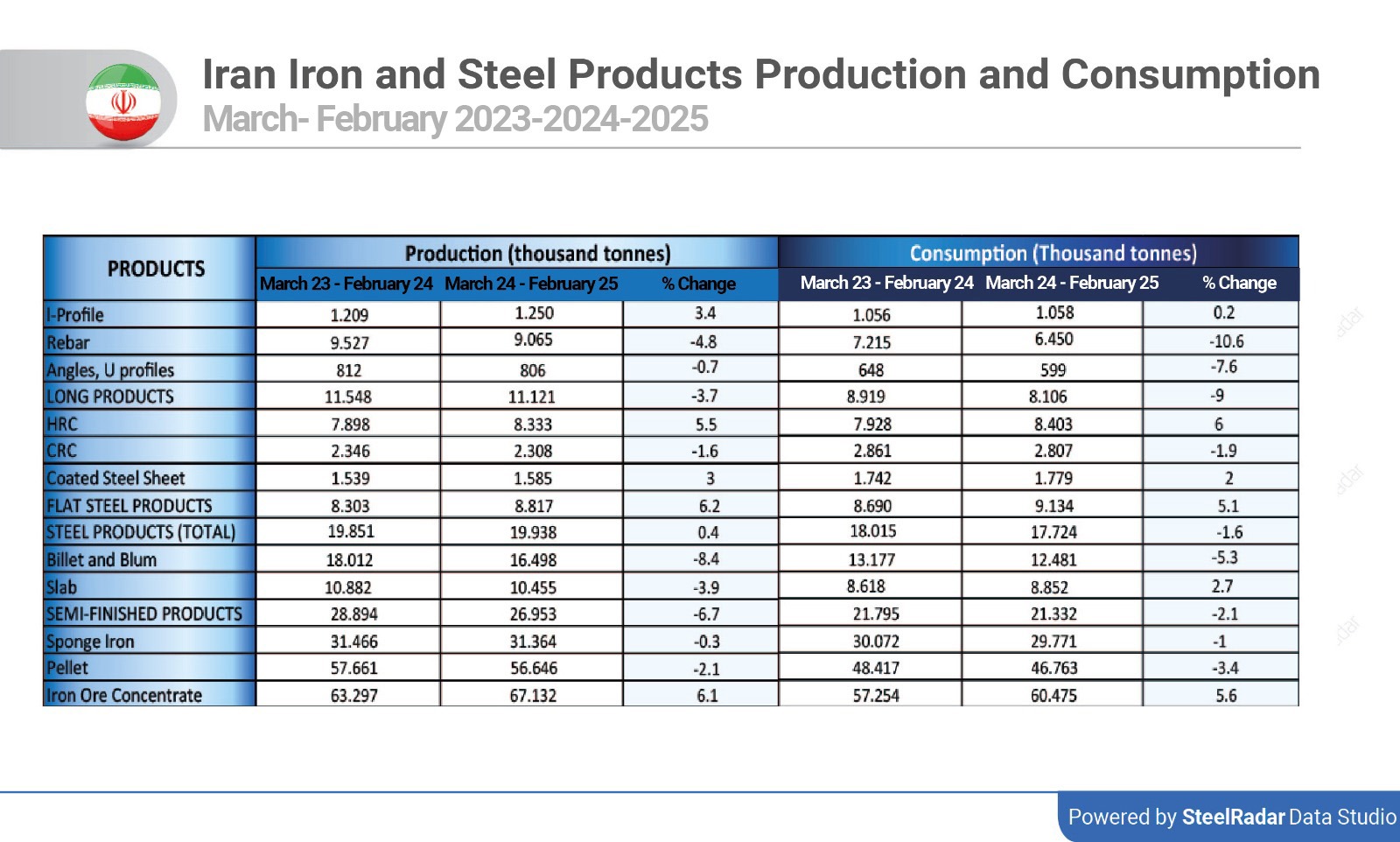

The Iranian Steel Producers Association has released statistics on the country's apparent steel consumption for the first 11 months of 2024 (March 2024 - February 2025). Accordingly, a mixed picture emerged in production and consumption trends, with increases and decreases in various product categories.

Production and Consumption Trends

Iranian steel production showed increases in some products. Hot rolled coil (HRC) production increased by 5.5% to 8,333 thousand tons and flat steel products by 6.2% to 8,817 thousand tons. Iron ore concentrate production also increased by 6.1% to 67,132 thousand tons. However, rebar production fell by 4.8% to 9,065 thousand tons and billet and bloom production by 8.4% to 16,498 thousand tons.

Consumption dynamics also reflected changes in domestic demand, with steel sheet consumption up 6% to 8,403 thousand tons and flat steel products consumption up 5.1% to 9,134 thousand tons. On the other hand, rebar consumption fell by 10.6% to 6,450 thousand tons, while angle iron and U section consumption decreased by 7.6% to 599 thousand tons.

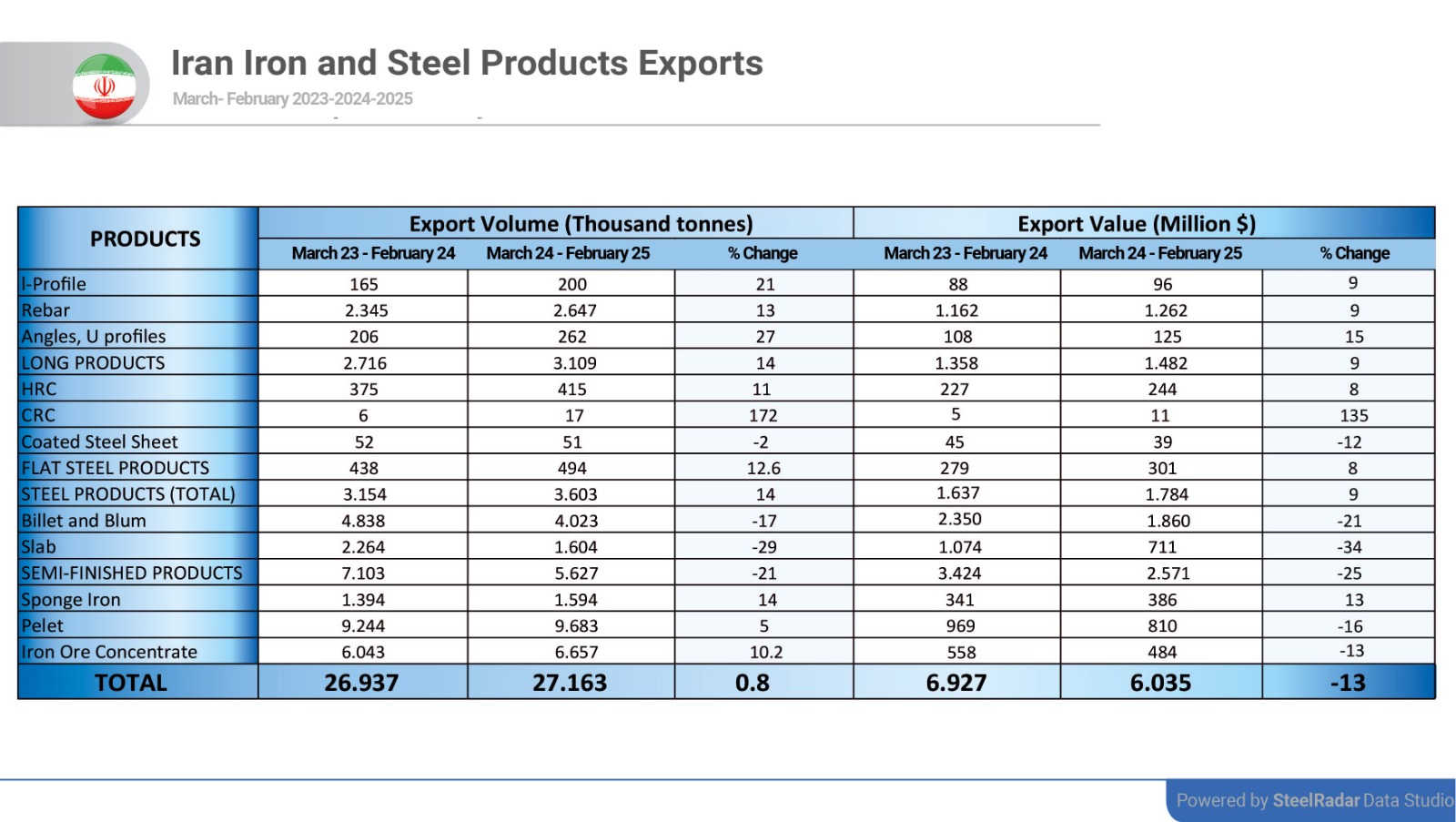

Export Performance

Iranian steel exports saw significant increases. The export volume of I-beams increased by 21%, while their value rose by 9%. The export volume of angles and U-profiles increased by 27%, while their value rose by 15%. The export volume of long products increased by 14% and their value by 9%. CRC exports fell by 1% in volume, but the value increased by a significant 135%. Sponge iron exports increased by 14% in volume and 13% in value. However, there were declines in exports of coated steel sheets and slabs; coated steel sheets lost 2% in volume and 12% in value, while slabs fell 29% in volume and 34% in value. As a result, the total volume of exports increased by 0.8%, while their value decreased by 13%.

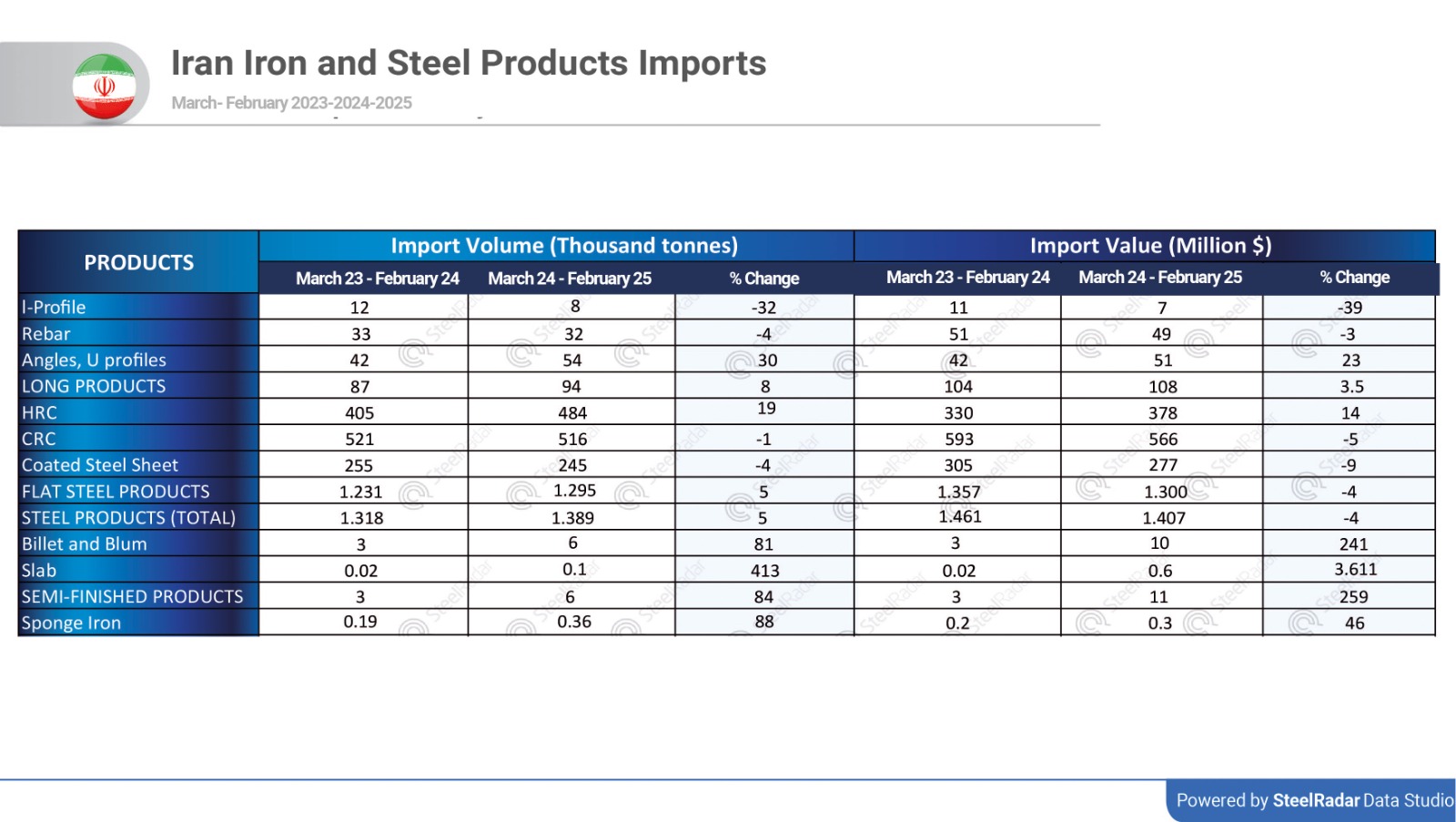

Import Trends

Imports of iron and steel products showed different trends. HRC imports increased by 19% in volume terms and 14% in value terms. The import volume of angle iron and U-profiles increased by 30%, while their value rose by 23%. Imports of semi-finished products increased by 84% in volume terms and 259% in value terms. However, the import volume of I-profiles fell by 32% and their value by 39%. CRC imports decreased by 1% in volume and 5% in value. Imports of coated steel sheets also lost 4% in volume and 9% in value.

Key Imports

Imports of iron ore concentrate increased by 10.2% in volume and 13% in value, while sponge iron increased 88% in volume and 46% in value. These developments reflected Iran's efforts to modernize its steelmaking capacity and reduce its dependence on raw materials.

Moderate growth in production and consumption showed that the Iranian steel industry is adapting to changing domestic needs. The increase in HRC and flat steel products indicates growing demand for these materials in the construction and manufacturing sectors. However, the decline in rebar consumption indicates a slowdown in some infrastructure projects.

Challenges and Opportunities

Iran's steel sector continues to face challenges such as geopolitical tensions, sanctions and currency fluctuations. However, producers can overcome these challenges by improving product quality, exploring new export markets and investing in technology improvements.

In conclusion, the Iranian iron and steel sector continues to navigate a complex environment influenced by both domestic and global factors. This presents the sector with opportunities for sustainable growth and competitiveness, but requires careful strategies.

Yorumlar

Henüz yorum yapılmadı